We also have been discussing the big Fed meeting that is now only 3 trading days away, where the media is absolutely certain the Fed will begin to taper their bond purchases. I have been quite confident that the Fed will not begin to taper at this upcoming meeting and still feel this way. However, I was much more optimistic of a positive market response when the SP500 was trading 50 points below current levels. It appears the market is front-running the Fed meeting and we will likely see a "sell the news" event. If (and its still a big if) the Fed decides to reduce purchases at the Wednesday meeting the market WILL be susceptible to a significant, knee jerk reaction to the downside. Now I am not the type of trader that will try to play this announcement; I will not be selling strong, winning stocks into the meeting, but I do feel that the downside risks at this point are much higher than they where two weeks ago. Typically when you see the market rally hard into a highly telegraphed news event, very often short term traders will sell ANY news that comes out regardless of whether it is good or bad. This is just something to keep in mind as we head into Wednesday. If the Fed decides to maintain its current course of action (meaning no reduction) I do expect the market to push higher, but the upside would be more limited than I have been expecting based on the last two week's strength.

Lets take a look at where we are after this weeks strong rally:

What price is saying that the short term downtrend has been broken, the prior resistance zone has been retaken, and a new "higher low" has been put in to trade against. The important levels to hold in any pullback will be the 1,668 swing point and then ultimately the 1,627 low. The 1,627 low will signal a break of the intermediate uptrend and leave the long term breakout in jeopardy. Those are the levels we will be watching to confirm our uptrend thesis and maintain conviction that higher prices are still to come. I do expect some mild weakness and/or choppiness heading into Wednesday's meeting, but will be looking for 1,668 to hold as support on any sort of retest of that level.

The weekly view has firmed up significantly over the past two weeks.

Since the close below the 20 WMA 3 weeks ago, the market quickly retook that average and this week pushed off strongly from that level. This was one of the key signals we wanted to see repaired to have conviction in the uptrend. In my view, the weekly chart looks very much intact and suggestive of new highs to come.

We saw some new highs in a couple key sectors this week which show even more reason to believe in the uptrend and to stick with the market leaders.

Industrials (XLI)

The Industrial sector made a new all-time high this week and proved that it is a major market leader. Since we have this new high, it means we can move our stop up to the new swing low. Our new stop will be placed just below the $44 level which coincides with the intermediate term uptrend support and the rising 20 WMA.

Materials (XLB)

Our newest position to the Portfolio is the Basic Materials sector fund XLB. XLB broke out of multi-year resistance on increased volume and close convincingly above the prior highs. This is very bullish behavior here and is coming from a highly economically sensitive sector group. I think this gives the market a new potential leader to push us to even higher highs to come. Just know the measured target from this mulit-year triangle formation is approximately $54 and some 30% above current levels. Our stop will be set below the prior swing low and 20 WMA at $40. For those counting at home this trade has a $2 risk for a potential $13 gain. That's 6.5/1 reward/risk from Friday's close and a probability I will take any day of the week. This is how you win in investing. BUY BUY BUY XLB! I'm pounding the table here!

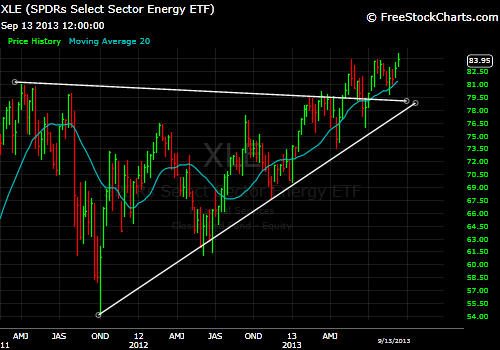

Energy (XLE)

The Energy sector made a new intra-week high as well and seems poised for higher prices. With oil holding in the mid $107's per barrel, the companies in this sector will make so much flippin money that its not even funny. Higher profits and earnings create higher stock values, stick with Energy. Because of this massive triangle formation I am not inclined to move the stop any higher than the previous low and breakout level at $79-$78. That will be our line in the sand for the Energy sector.

It is a very strong signal to see rotation of this magnitude within the sector groups. Industrials, Materials and Energy are now becoming the new Generals in this market and that is a very healthy sign for prices moving forward. Along with strong continued leadership in Discretionary, Technology, and Healthcare, the "right" sectors are in front and should push the averages higher. Even Financials were able to retake its 20 WMA, although it still has some work to do to completely right that ship. And then to see Staples, Utilities and Bonds lagging considerably only confirms the risk appetite of money managers and that usually means good things for the market going forward.

There was not too much to report this week from our holdings as most simply churned and continued to hold key support levels. CMI was the notable winner this week however posting a gain of over 5% and setting a new all-time high. AAPL was the notable loser as investors were disappointed with the "big announcement" that was hoped to be a joining with China Mobile, but ended up being just another, ho-hum phone with a slightly lower price point and fewer features.

Cummins (CMI)

AAPL

While the announcement results disappointed many speculative traders hoping for a quick pop, there was still relatively little technical damage done to the weekly chart. I will be concerned however if the stock does not stabilize here on its breakout retest. I am moving my stop to the 20 WMA and the $454 swing point. If that level and breakout fails to hold, we will want to step aside and let this one set up again.

Holdings Performance last week:

CMI +5.1%

F +2%

SP500 +1.9%

PPG +1.9%

WFC +1.8%

PBW +1.5%

HAIN +0.8%

DDD -2.6%

AAPL -6.7%

Cash positions:

HD +3.3%

ENB -1.8%

No comments:

Post a Comment