What we are listing here are all the things that could pop up to derail the equity markets' rally. However there is a common maxim on Wall Street that its not the known concerns that are the issue (theoretically the market has factored in these events and their likelihood), rather its the unknown unknowns that are the real problem. But for now we seem to be dancing that line of buyable dip or significant corrective action. Since we have now ended another month we will take a look at multiple time-frames, from long to short, to try to discern what all this nervous talk actually means for our investments.

We will start with the shorter, Daily view and move through the Weekly and Monthly views as well.

SPX Daily 1-Year (Bearish)

Last week we retested the prior support zone we were watching so closely and that proved to follow suit and hold as new resistance. The market will need to take that level out to the upside if this short term view is going to turn around. We seem to have found some support at the new uptrend support line from the November low and the June low. However we also see a down sloping 20 DMA that too will act as resistance on the way back up. The first thing we want to see accomplished here will be for the support line and last weeks' low to hold. Then we will need to see the resistance near 1,670 taken back. If this low fails to hold, the last line of defense will be the June lows.

SPX Weekly 3-years (Neutral)

The Weekly view shows a similar picture for the near term. Price this week closed below the rising 20 WMA for the first time since January; the 20 WMA is a major indicator that I use to determine market health. Typically when price is above the 20 WMA odds for higher prices are better, when price is below the odds for lower prices are more likely. We will need to see that average retaken soon to have more confidence that the top is not in. We will be watching the same things on the Weekly view that we are watching on the Daily view above. I will be watching for the uptrend line and the 20 WMA to hold as support for the rally to continue. Or I will be watching for a continuation of the pullback and possibly a significant correction back to the weekly channel lows near 1,450.

SPX Monthly 15-years (Bullish)

Here is where I feel the perspective still shows bullish implications; this is the Monthly bar chart. With all the "doom and gloom" talk going on in the world, the market is STILL holding above its prior all-time highs and is STILL in breakout territory. As we have discussed in the past, we want to be bullish and invested ABOVE this level. The level happens to be right at the 1,559 area and corresponds to the June lows. You can see why there is so much importance placed on the June low at 1,559. It is not only the prior confirmed higher low in the intermediate-term uptrend, but it is also the long term resistance level for the SP500. Just as in the Daily view where the short-term support area at 1,670 was support and turned into resistance, this 1,559 resistance level should now turn into support since its been broken.

The bottom line is that while there are signals that the market may correct significantly from these levels, it is still to be seen that the longer term support we are watching will fail to hold. As of right now the market is at a critical juncture on multiple time frames, it is still holding above key support levels for now, but is showing some signs that it may be looking to correct or consolidate for a longer period of time. There are a lot of things to fear right now in the market but until price confirms that fear on the longer term time frame, we are still in a position of strength with the current uptrend.

On that note, we only lost one of our holdings this week, but it was a big one. The Financial sector group (XLF) failed to hold its key support levels last week and is a major crack in the markets armor. Maybe it will be a false breakdown and it will rally right back, but as of now the risk/reward is no longer favorable.

Current Holdings:

XLY, XLK, XLI, XLE, XLV

HAIN, DDD, CMI, AAPL, F, PBW, WFC, PPG

Cash Positions

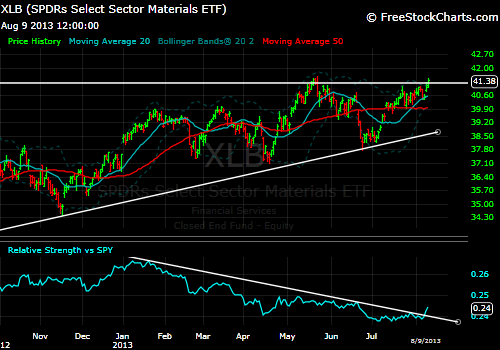

XLF, XLB, XLP, XLU

ENB, HD

We had two notable winners this week with DDD and HAIN showing excellent relative strength. Several of our holdings are still breaking out against the market on a relative basis and seem to be holding up better than the overall market also.

DDD

DDD finally broke out above the key resistance level of $51 this week and although it broke out once and failed, it was able to bounce right back and close at a new weekly all-time high. Looking good with DDD.

HAIN

HAIN was able to hold right at all time highs this week after last week's big breakout. The very tight consolidation this week, while the market corrected, was a sign of strength and likely higher prices to come.

Our other holdings that have shown good relative strength recently are:

PPG

While PPG is testing its 20 WMA, it is still a ways from its long term trend support. During this market's correction PPG has broken out on a relative basis as shown below. I'm willing to give this room down to the prior lows at $144 because of the recent and prior strength.

CMI

Cummins hasn't done a whole lot since we bought it. It has had a couple nice attempts to move higher, but just hasn't been able to put together a hot streak yet. That being said, it has HELD its breakout and the RS trend has been steady since its breakout also. The fact that this has held up well with the market rolling over it also a very good sign for it going forward should the market rebound.

AAPL

It's pretty much the same here with AAPL as with CMI. It broke out strongly a couple weeks ago and has simply consolidated its move while the SP500 has corrected. The RS trend is strong here and showing nice rotation into the stock.

XLE

Energy is looking good. We saw a nice relative breakout this past couple weeks and price has held well above the key $79 level. Energy will be a group that flourishes during global unrest, is this chart telling us that a potential excursion to the Middle East will linger longer than expected? Remember the scandals with Haliburton and Dick Cheney? The Iraq war began in 2003, what did Haliburton's stock do beginning in 2003? From the beginning 2003 through 2005, the stock gained from $10 to over $40