What's crazy to me, is that it is contrarian thinking to be

positive on our future as a country. I deal with the general (and not so general) public in my day to day business. I make eyeglasses and am running my parents 32 year old self-employed business. Being that I sell eyeglasses, I get to meet and talk with almost every kind of person alive. No matter your race, age, demographic, political views, religious views, everyone shares in the dubious gift of poor eyesight. While talking with these folks, conversations often slip outside the bounds of the eyecare landscape and we share many things. We talk about my new family (the older gals love the pics of my baby girls), their families, music, movies, and yes often the "future".

A recurring theme that continues to find its way into conversation is some sort of negative event headlined future, generally resulting in our demise. I know, cheery stuff right? Especially when all I am suppose to be doing is helping them see. They tell me about the next imminent environmental calamity, or how the US Federal debt levels are so high that we will soon witness the collapse of the American government and there will be total anarchy. Or they say how my generation will be the weakest economic driver in history due to our current outstanding student loans and our inability to find employment. And I hear all that just in my normal 9-5!

Then we hear and see it in our homes. We see it on the news, in the media and in our regularly scheduled programming. Amazon Instant Video offers an interesting service where they release a series of "pilot" episodes of original series and viewers get to vote for which show they like the best. But I noticed that at one point nearly half of the offered shows involved some form of post-apocalyptic America lifestyle. One was an alien invasion, another was environmental disaster, one was civil war and anarchy. You get the point.

Everywhere I turn these days its going to be the end-of-the-world and there is nothing we can do to stop it. The wheels are already in motion and its going to happen any day now.

Putting the Sci-Fi theater aside, most Americans seem to think the economy is in dire trouble, the government is on the brink of meltdown, and that our current and future generations are pretty much sunk. However I tend to see all of those negatives as some of the strongest potential catalysts for improvement we have EVER seen. I want to highlight 4 key catalysts for America's

very bright future ahead:

1. Education

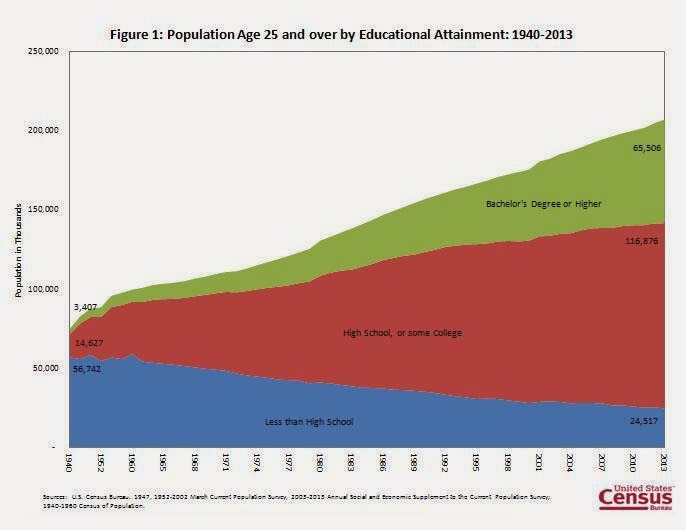

Yes we, as a whole, carry large amounts of student debt. Which they say we will never pay off, we won't be able to buy houses either because no bank would loan someone that high risk more money. But consider as a society becomes more educated, it is able to excel and develop new technologies that improve the efficiency of that society. If you look at the historical data of US education rates,

especially those earning a Bachelor's Degree or higher, we are at levels never before seen in our history. If logic follows, it would make sense that our brightest years are ahead of us due to the dramatic increase of higher education rates.

Another interesting tidbit for a consumer based economy is this: The average wage for a college graduate is significantly higher than that of a High School diploma earner. If we have the highest college education levels in history, it would follow that we will earn at the highest level in American history. People making more money is good for economic activity.

2. Employment

Recently we have experienced a relatively high level of unemployment in America. The Great Recession included a spike in unemployment rates not seen since the early 80's. At the height of the recession unemployment levels were at 10% in 2009

I view our current landscape very much like what we saw in the early 1980's. Unemployment was high due to the largest generation in American history at that time (Baby-Boomers) entering the work force. But over time they found work, started families, bought houses and grew the economy.

Currently we are being held back by the last "hangers-on" of the Boomer generation, who have needed to work extended years to pay for their retirements and health care. In my opinion we have seen the worst of this and over the next 5-10 years these desperate souls will be forced to step aside for their younger, more educated successors (that's us!). This will cause unemployment to continue to decline, will allow for student loans to be paid down and our generation will begin to perpetuate the cycle that our parents did. We should expect at least a similar growth achievement compared to the 1980-2000 advance.

Jobs cure all, especially in a consumer based economy. Once our parents get out of the way and stop blocking our job entries, things should continue to improve dramatically.

3. Housing

It is my opinion that the rental market is in a bubble. No one is talking about it, but I see it everywhere. The fact that no one is mentioning a potential peak in rent rates and apartment construction makes me believe even more strongly that we are near a turning point.

I would like to highlight a couple key facts as to why now (from 2010-2020) is the time to be a BUYER, not a renter:

1. 30-year fixed mortgage rates are at ALL-TIME historical lows (even with the recent increase over the past year). 4.25% is not a high interest rate. I expect rates to stay low for the foreseeable future, but they won't stay low forever.

2. Rental rates are continuing to rise and are at some of the highest levels they have ever been

3. Many struggling recent college graduates are still waiting to start families and settle into stable careers

-Most are renters and many others are living back at home until they can get on their feet.

-This generation of potential buyers is the largest generation in our history

All of these points highlight one simple thing, Housing has an enormous potential to grow over the next 10 years as jobs open up and more new families begin to seek permanent homes. The nay-sayers point to this delay as a major road block for our continued economic progression. However it is apparent to me that these concerns are playing out currently and only present upside surprises from here. Conditions continue to favor improvement since the worst levels we have seen in our lifetime are now behind us (2008 recession).

4. Energy Independence

You want a way to pay off the ungodly trillions of dollars in US Debt we currently have? How about through the exporting and lack of importing foreign oil. At the current price of oil, WTI is just under $100/barrel, how many barrels of oil would it take to pay off our debts? The current consumption rate of oil worldwide is roughly 85,000,000 barrels/day, which equals $8.5 Billion a day. If the US controlled the majority of the worlds reserves we would be in a very strong position to not only grow our economy but also get ourselves out of any debt problems really quickly. While some of the data is still speculative, it is widely known that the US has the potential to be far and away the leader in global energy production going forward. New oil discoveries are said to have more oil reserves than the entire middle east.

-The Bakken, the Eagleford, Green River...All of these discoveries could make the US completely energy independent within the next decade.

-The primary concern with US oil extraction is the potential environmental damage and I feel that once some of the more archaic practices see technological improvement, this will be a

reduced (not eliminated) impact.

Another very interesting movement in the energy space is the increase in infrastructure dedicated to renewable energy sources, with solar being a leader for growth going forward.

Take a look at this for a positive sloping trend:

The amount of solar energy being produced has never been higher and we have seen a clear shift in the aggressiveness of that movement. We have also seen large steady growth in connection capacity over the past 6 years.

US Grid Connected Photovoltaics Capacity (MWp) |

|

|

| 2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

| 474.8 |

791.7 |

1261.6 |

2165.7 |

4,010.70 |

7373.8 |

|

Every bit of energy we generate from our own resources is that much less that we have to buy from someone else. The days of seeing energy as a drag in America is ending. We are seeing huge potential opportunities now both in crude oil deposits and in alternative energy infrastructure.

-The possibility of Tesla's

"Giga Factory" could begin to revolutionize our energy storing and transporting needs as well.

My discussion today is meant to show the other side of the coin. I absolutely agree that SOMETHING could go wrong and the world may undergo a dramatic shift. But what if it doesn't? You spent your entire life expecting something that never came and now you failed to plan for the alternative. The way I see it, if any one of many major calamities occurs on Earth in our lifetime, we will all be pretty much screwed anyway. You shouldn't stop living because you know one day you will die.

What America is and where it came from, not a single person that had a major hand in the development of America was a pessimist. This thinking that only something bad can happen is a very extreme position to have, it is just surprising to me that so many share the same view.

I for one will continue to bet against the herd and continue to live happily with my loved ones. Its never a bad idea to prepare for emergency circumstances, but to KNOW an imminent disaster is upon us and live your life around that bubble is crazy to me. I expect things to go pretty much as they always have, forward. We continue to live longer, have lower infant mortality rates, more knowledge, better technology and continued opportunity.

If I was a betting man, my money would be on America.