This week I want to do something different than my normal recap. I don't usually share my shorter-term trading information, but I needed to work through some numbers this past week and came to some notable conclusions.

We live in a short-term world; we want things fast, accurate, and actionable. But we often neglect the longer-term results to appease these short-term desires. This past year markets have been mostly directionless and with heightened volatility. For a trend trader, regardless of timeframe, it's been a difficult market for many.

Because of this fact I wanted to look over my recent trading results to see if I could do better than my current trading suggests. YTD my short-term accounts are down -3.2%. I'm not pleased with this. I've done worse in the past, but I've done better also. I wanted to figured out when did my best trading spans occur, and under what market conditions (both the broad market and the stocks themselves) did my performance either flourish or falter.

So here is what I did. I broke the broad market into two periods, either with a rising 20 WMA or with a declining 20 WMA (using the SP500). Then individual stock positions were measured from the entry price to the 20 WMA on entry. The thinking being that I wanted to see if trades were performing better during times of higher momentum or after a pullback. Individual entries were broken into two categories either < 10% above the 20 WMA or > 10% above the 20 WMA.

Note: the current environment has been one of a choppy range bound market. These results may differ in a stronger trending market. However we have had a few strong moves this year to extrapolate data from.

Results:

I have taken 61 trades this year. 25 winners and 36 losers. That's a total win rate of only 41%. Certainly this leaves much to be desired.

-Positive Sloping 20 WMA for SP500

Trade entry < 10% above the 20 WMA

16 trades (11 wins, 5 losses) 68% winners. Return +5.53%

Trade entry > 10% above the 20 WMA

15 trades (7 wins, 8 losses) 46% winners. Return +.62%

-Negative sloping 20 WMA for SP500

Trade entry < 10% above 20 WMA

17 trades (6 wins, 11 losses) 35% winners. Return -1.32%

Trade entry > 10% above 20 WMA

13 trades (1 win, 12 losses) 8% winners

Return -8.08%

The results are helpful. Maybe obvious to some, but helpful for reinforcing good trading habits none the less.

Ultimately all gains came while the SP500 had a positive sloping 20 WMA. All losses came while the slope of the SP500's 20 WMA was declining. Trades with a +20 WMA returned +6.15% and a 58% win rate vs a -20 WMA -9.4% with a 23% win rate.

Individual trade results were much stronger when entries were made closer to the longer-term moving average. Trades taken within 10% of the 20 WMA showed a return of +4.31% and 51% win rate, regardless of market direction. Trades entered more than 10% above the 20 WMA returned -7.46% and 28% win rate.

Conclusions:

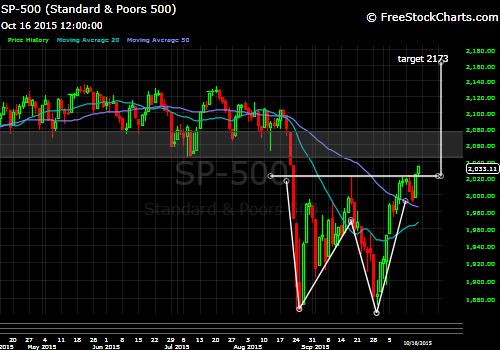

Despite all the feelings of "missing out" during volatile market conditions, odds simply do not favor my strategy when the overall market trend is declining. Had I simply not taken a single trade while the 20 WMA was declining I would have a solid gain on the year. This also would have occurred despite not taking a single entry signal on this recent 5-week 200+ point rally in the market. (The 20 WMA for the SP500 remains with a negative slope).

The data also suggests that when entering new trades, the most profitable and highest odds trades setup closer to the longer-term moving average.

The combination of taking Long trades after some consolation/pullback AND while the overall market is in an uptrend, is the highest probability for a successful trade.

Conversely, the combination of entering Long after a sharp move higher while the overall market is in a downtrend is a disastrous proposition for returns.

There are times (like this past month) where shorter-term trends can emerge and offer profitable trade opportunities while the longer-term trends are negative. A way to navigate this environment, knowing the odds generally are working against you, is to simply reduce your trade size during those conditions.

For example new trades entered when the longer-term trends are in your favor can be taken with a ~1% risk per trade. While new trades entered when longer-term trends are not in your favor should be sized smaller, maybe .5%-.25% risk. This way you can still take new trade signals regardless of market direction but will also be adjusting risk accordingly to the more or less challenging environment.

There is no right or wrong way to trade. But it is very helpful to understand when your strategy is in favor and out of favor. Either choose to only trade when conditions are the most favorable or have risk measures in place to adjust if conditions become unfavorable.

The takeaway from this little study is that regardless of what the action in the market is and despite the media's focus on the day-to-day gyrations, knowing when your strategy is most successful and maintaining the discipline to only trade during those times will work wonders on your long-term results.

When it comes to investing, we should gauge ourselves on our longer-term expected returns. It is and will be very tempting to take trades regardless of general market direction. The important thing to realize though is that by getting pulled in by the short-term movements and emotions involved with watching the market too closely, you will be neglecting your long-term returns for short-term emotional stimulation.

Good investing is based on sticking to high probability trades and situations; good investing should be boring. I would encourage you to go through your trade logs and begin to understand exactly when conditions are most favorable to your strategy's long-term results. Even if you know what the answer is before you start (its pretty obvious that when the market is uptrending that trades are higher probability), having the data to back up your actions will go a long way to helping your confidence when your returns may lag for periods of time.

Thanks for reading

-ZT