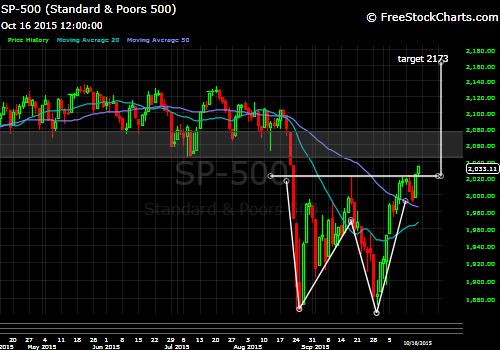

SP500 Daily Double Bottom

The setup will likely not be easy to complete as the SP500 is now just below the declining 20 WMA and range resistance. We've looked at this many times and continues to shape the intermediate term thesis.

SP500 Weekly

SP500 Weekly

While most are convinced that sentiment is bearish, I continue to be surprised by the confidence many are giving to an "end of year rally". It's basically assumed now that markets will just rip right back to the highs. Granted we do have some price confirmation of this theory (Double Bottom in motion), but for more than a year now this market has squashed many a bullish setup shortly after the herd piles in. Short-term the price action remains constructive, but confidence appears high to me, especially considering we have rallied almost 200 points in a little more than two weeks.

Regardless of what we think will happen, keeping an open mind is very important for successful market performance. That being the case, should the market be able to surmount this overhead supply level, there will be many stocks within our Large-Cap universe that setup for potential upside and favorable risk/reward. Here are some I like and will be watching.

No comments:

Post a Comment