SP500 Monthly

Our Large Cap Portfolio added a new position in GOOGL at the close of July and is now fully invested.

Long: FB, GE, AEP, PCG, PM, UNH, SHW, MDT, MSFT, CVX, LOW, VZ, CSCO, COST, CMCSA, PEP, GOOGL

Short (via Put Options): BAC, C, GILD

Our posture is quite diverse and bullish. We hold many higher yielding assets as well as some growth oriented names. The few Short positions we hold still reflect the longer term price action, although it should be noted our Bank Puts are mostly dead at this point. We will still hold them as they expire in September and there would be very little added benefit to selling them now.

LONG

FB

Facebook reached new highs this month after thrashing earnings estimates once again. The stock faded following the initial reaction but was still good enough to finish July at a new monthly closing high. We can now trail stops to the low of the recent consolidation at 104.40.

GE

GE faded at what is clear overhead resisitance. The $33 level goes back to major support prior to the Financial Crisis. It may require more backing and filling in this range before it can make another run at new highs. For now we still have higher highs and higher lows and will await a higher monthly close before we trail stops further.

AEP

PCG

Both AEP and PCG made new highs this past month but faded the last couple weeks. There is really nothing to do here even though these prices are getting a little stretched. We could use some consolidation before we are able to trail stops again.

I actually trimmed a little off on Friday (1/4 position) mainly to cover costs of our new GOOGL purchase. There is no need to do so technically but I felt these were the most vulnerable names to a pause at current levels. I joke with myself when I say "how do you insure that your stocks continue higher? Sell some of the position". More often than not it seems stocks always continue to rip once I trim exposure. Needless to say I would be fine with more upside from here, but realistically a defensive group like Utilities tends to revert once it becomes more than 15% above its 20 MMA.

If we are indeed entering a new secular bull market utility stocks would be a source of funds for managers looking for more growth. Just keep that in mind as we go forward. While they could always continue higher, intermediate-term we have had a great run and some rotation of funds into higher growth may be a fine play.

PM

PM is just flagging above its prior highs. A resumption higher soon could allow us to trail stops, but for now we will let this rest after a monster run.

UNH

UNH continues to stretch out. Nothing to do here until it cools off and forms another base. Letting it run.

SHW

Sherwin had a volatile month but closed well off the lows. With the new monthly closing high we can trail stops to June's lows at 278.74. This is a nice little flag breakout and should be suggestive of higher prices to come.

MDT

Medtronic has been a ripper as its emerged from its 18-month base. Nothing to do but hope it pulls back and builds a higher low to trail stops.

MSFT

MSFT broke out of a multi-month bull flag in July and allows us to trail stops to the June low just above $48. If we were not involved already, this would be a place to initiate a new position. Since we are long we can trail on up to the new higher swing low.

CVX

Cheron continues to hold above $100 support. Oil looks a little vulnerable here if support should fail, but overall CVX is hanging in there well.

LOW

Lowe's finished the month at all-time highs We are keeping stops where they are for now but it is nice to see it moving in the right direction.

VZ

After the recent spike VZ is consolidating at the highs. We are giving this plenty of room to wiggle as the long-term setup is very much in our favor. That and we are being paid more than 4% just by owning the shares.

VZ is a solid foundation for any long-term income/growth portfolio.

CSCO

"Old Tech" is seeing strong rotation, MSFT, INTC and even CSCO are steadily pressing higher from major multi-year base formations. Considering the high dividend payouts, these remain very strong positions and could just be getting rolling.

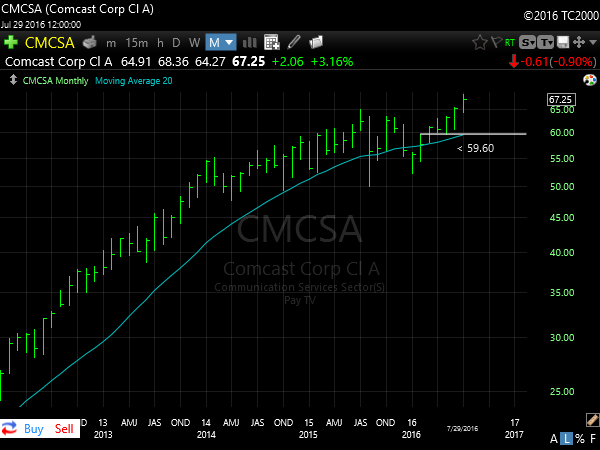

CMCSA

Comcast continues to stretch its legs and push to new highs. This is getting off to a very nice start for us and is a leader in the new leg of the bull market.

COST

Costco showed some strong follow-through after our entry signal last month. After a 2-year sideways period COST could be ready to press to new highs.

PEP

Pepsi pressed higher this month and is now in a position to allow us to trail stops. We can use the new higher pivot low at $100 as our trend invalidation point.

+GOOGL

Our new addition for the month of July is Google. After 9-months of consolidation the stock broke through downtrend resistance and set a new monthly closing high. Earnings last week were strong and the Street rewarded them. This is exactly the type of "bull flag" setup I look for and is emblematic of a new trend beginning.

Initial stops will be placed at the new higher low at $672. It seems like a wide stop but remember we are not hoping for a 10% pop in the stock. Our objective here is for much more upside than that. With a trend this strong we want to give it plenty of room to develop in the future.

SHORT

BAC

C

Banks are acting quite well over the short-term, the longer-term however still shows quite a bit of weakness. Unfortunately for our Put positions we may run out of time before we get follow-through lower.

The recent market strength has seen solid participation for Financials which is to be expected. It will be interesting to see what comes of the next few months. Should Banks continue to churn we may look to roll out to further dated Puts or step aside completely depending on further money rotation. But for our timeframe here these names still remain largely weak.

GILD

Gilead looks like a solid bet to continue lower. With a poor earnings reaction this past week the stock took a tumble. We are now only 5% from our Put strike at $75. It doesn't mean we will sell there, but we will evaluate the situation. We have until October before our contracts expire which gives us plenty of time to let things develop. So far, so good.

Markets are pushing higher into the summer and to most people's surprise. There remain many skeptical of the recent breakout and positioned poorly for higher prices. We continue to be undeterred from their malaise as we have been steady buyers since the March recovery. As long as prices remain firm and the market is in an uptrend we will stick with our holdings and participate.

The time to take our foot off the gas was back in August 2015. Markets churned for 10-months following that breakdown and now we are seeing the exact opposite...new highs. Now we put hammer down and trade this market aggressively. Sure there will be pullbacks along the way, but for now prices are pointed up and we are along for the ride.

Thanks for reading

-ZT

No comments:

Post a Comment