Declining leadership has been discussed ad nauseam in 2015 and this week we actually saw some big bull market leaders come slamming down. Last week we discussed our exit in AAPL, when AAPL breaks trend I take notice. When a name like DIS declines 10% I get a little queasy.

Early Friday morning it looked like we would be receiving 3 more exits (TWX BMY DIS), yet 2 of the 3 recovered enough to survive at least another week. We did receive exit signals for TWX as the beating it took after its earnings Wednesday was too much to overcome.

Exit TWX

This is something that you don't want to see if you are long a stock. TWX had all the makings of a strong rally candidate: Large constructive base at multi-year highs, a breakout above those highs, and outperforming relative strength. All these factors were aligned when Time Warner announced better than expected earnings Wednesday morning. The market was up 1% early on Wednesday yet the stock was sold hard losing 10% on the day.

When a stock is setup for a strong breakout yet cannot rally on "good news", it is a sign that risk is elevated. This is something that we focus on here, we want to be positioned in stocks that are behaving well and showing strong risk/reward. When the risk suddenly out sizes the reward we step aside and wait for a better opportunity.

TWX isn't dead in the water here however. On the monthly timeframe it is still holding its "bull market" support line, the 20 MMA.

The 20 MMA has held as trailing support for much of this stock's tremendous rally off the '09 lows. I will keep it on the watchlist to see how it handles this longer-term support area in case this was simply a fake out move within a longer term uptrend.

But for now we sell and await a new signal.

When a stock is setup for a strong breakout yet cannot rally on "good news", it is a sign that risk is elevated. This is something that we focus on here, we want to be positioned in stocks that are behaving well and showing strong risk/reward. When the risk suddenly out sizes the reward we step aside and wait for a better opportunity.

TWX isn't dead in the water here however. On the monthly timeframe it is still holding its "bull market" support line, the 20 MMA.

The 20 MMA has held as trailing support for much of this stock's tremendous rally off the '09 lows. I will keep it on the watchlist to see how it handles this longer-term support area in case this was simply a fake out move within a longer term uptrend.

But for now we sell and await a new signal.

DIS and BMY are getting too close for comfort:

DIS

Disney really took a thumping this week. A move we have not seen the likes of in a number of years.

It did manage to hold the swing low support at $108 so we are still with our position, but the environment has seemingly shifted.

Taking a glance at my indicators we saw a volume move that has not been equaled since 2011 and 2008. In both cases the stock continued lower for some time. Our trend momentum indicator, the MACD, appears to be putting in an intermediate term top. Relative Strength vs SP500 is confirming price and holding its uptrend for now.

Both Volume and Momentum have shifted bearish with this week's action, yet Price and Relative Strength continue to hold uptrends. For now we will stick with the position as we have not seen the lower low to invalidate the trend. Price is the final arbiter, we always default to it rather than reacting based on an indicator. The indicators do have value though in alerting us to a potential problem ahead. So it tells us we now need to pay extra attention and be ready to act should we receive a sell signal from the market.

What makes you successful over the long-term is remaining disciplined in your process and sticking to a winning strategy. Our stops are in place for a reason, not only to take us out of a position, but also to keep us in them through trend completion.

It did manage to hold the swing low support at $108 so we are still with our position, but the environment has seemingly shifted.

Taking a glance at my indicators we saw a volume move that has not been equaled since 2011 and 2008. In both cases the stock continued lower for some time. Our trend momentum indicator, the MACD, appears to be putting in an intermediate term top. Relative Strength vs SP500 is confirming price and holding its uptrend for now.

Both Volume and Momentum have shifted bearish with this week's action, yet Price and Relative Strength continue to hold uptrends. For now we will stick with the position as we have not seen the lower low to invalidate the trend. Price is the final arbiter, we always default to it rather than reacting based on an indicator. The indicators do have value though in alerting us to a potential problem ahead. So it tells us we now need to pay extra attention and be ready to act should we receive a sell signal from the market.

What makes you successful over the long-term is remaining disciplined in your process and sticking to a winning strategy. Our stops are in place for a reason, not only to take us out of a position, but also to keep us in them through trend completion.

BMY

BMY took a solid test of support this week and is now below a declining 20 WMA. There should be substantial support in this area, our stops remain just below. Relative Strength broke a year long uptrend which suggests a weaker trend is likely. We will simply need to watch this closely for any further downside follow-through.

FB and SBUX remain strong

FB

Facebook hung in there this week and managed to finish higher. We can now safely trail stops to the 85.23 level which represents the prior all-time highs from Spring and where support held in July. A break of this level, which would also break the rising 20 WMA would be enough for us to comfortably step aside until a clearer picture emerged.

Should the market find its footing soon, FB is setup to remain one of the few leaders left in this market.

Should the market find its footing soon, FB is setup to remain one of the few leaders left in this market.

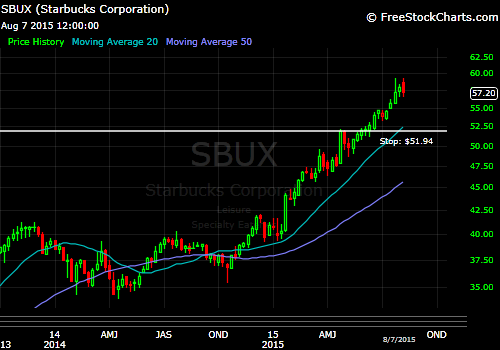

SBUX

Even the mighty SBUX came under pressure this week. It wouldn't surprise me at all if SBUX began a bit of a correction soon, its been absolutely relentless since November. But we never can know where we are in a trend so we won't play the guessing game. We will raise our stops a tad up to the $52 swing point and give this plenty of room to take a breather.

After seeing AAPL go down and the potential of other leading stocks DIS and BMY to follow, should SBUX come under pressure I would become quite concerned with the health of the overall market. The strongest market leaders are always the last to give way before a major correction. When they do finally break, things can devolve in a hurry. The last two week's price action in the true bull market leaders has got me on full alert.

After seeing AAPL go down and the potential of other leading stocks DIS and BMY to follow, should SBUX come under pressure I would become quite concerned with the health of the overall market. The strongest market leaders are always the last to give way before a major correction. When they do finally break, things can devolve in a hurry. The last two week's price action in the true bull market leaders has got me on full alert.

Financials continue to hold up relatively well

WFC

AIG

GS

The Financials continue to carry this market. All three of our XLF positions are holding their respective breakouts. Until this changes we will stick with the leading group and let the market tell us when its time to adjust.

Healthcare saw some pressure, but mostly remains strong.

GILD

GILD remains constructive as it has held above its prior highs while the market has struggled. We can slide up our stops to the earnings low of two weeks ago. A break of 108 would put me in a much more neutral stance.

UNH

UNH held up nicely this week but its still within that pesky 2015 trading range. Momentum still favors more consolidation within a larger uptrend as it has not bottomed out yet. As long as UNH can hold the support lows at 113.20 I think this will eventually create another strong buying opportunity.

And surprisingly HON is just hanging tough.

HON

Honeywell was cool as a cucumber this week and now sits back at its upper range. Again if the market can cooperate a bit this one has a chance to push to new highs soon. Nice resiliency.

Due to our recent stop outs we finally have some new cash to deploy should opportunities arise.

This is exactly what I mean when I discuss rotation and relative strength as a risk management strategy. The market tells us when and where to position our free capital. When the market is vulnerable we will be seeing exits triggering and not many new setups emerging. This naturally moves us into a more defensive position. We can rest easy while holding extra cash, knowing that when the market regains its footing there will be a plethora of new high reward opportunities presenting themselves. Until that happens however we will continue to let our existing positions run and manage risk as it comes.

Here are a few names I will be watching in the coming weeks:

Due to our recent stop outs we finally have some new cash to deploy should opportunities arise.

This is exactly what I mean when I discuss rotation and relative strength as a risk management strategy. The market tells us when and where to position our free capital. When the market is vulnerable we will be seeing exits triggering and not many new setups emerging. This naturally moves us into a more defensive position. We can rest easy while holding extra cash, knowing that when the market regains its footing there will be a plethora of new high reward opportunities presenting themselves. Until that happens however we will continue to let our existing positions run and manage risk as it comes.

Here are a few names I will be watching in the coming weeks:

HD

LMT

NEE

PEP

No comments:

Post a Comment