In this shortened week not a lot was accomplished. The S&P did reach a new high this week, but closed only 1 point higher than last week. The market still seems in creeper mode, but we could see volatility pick up next week as traders will have lots of time to digest the retail numbers from Black Friday. There is no rule that says the market has to pullback, but I expect we could see a small "sell the news" into official Black Friday results. That's just my feel. Feel doesn't matter much with a trend following strategy, so as always we will wait for price to confirm any sort of negative momentum before we get bearish on stocks.

This week makes 8 consecutive weeks of higher prices for the market and its got to come to a halt at some point. When I'm looking at my positions I see many places where a little pullback would make sense and then refresh the next move higher. I'm not thinking big drop or anything, clearly the bid for stocks is too strong for the bottom to just fall out, but it wouldn't be a terrible thing to see a couple lower weeks in the early part of December. I feel very confident with my stop placements on our holdings and believe a refreshing correction could open some decent swing opportunities coming into year end. You have to be willing to let some of your gains go to really catch all of a powerful up move. Markets don't just move in one direction, but you have to be willing to sit through some healthy pauses to keep yourself aligned with the bigger picture. And if the market decides to move into a deeper correction mode, we will follow our stops and step aside before too much major damage is done. Always remember to manage risk first.

That being said we do have a couple positions that need monitoring and a few others that might be ready to continue to the upside. Let's take a quick look.

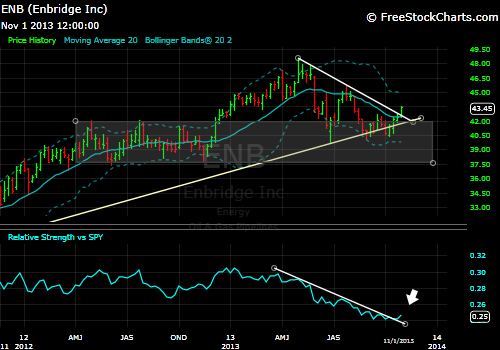

Enbridge (ENB)

ENB is still struggling to put together a rally. We continue to see selling and closed lower on the week. This was also a confirming week with a second consecutive close below the 20 WMA (which has turned down after this week). I am still positive on the position above the $40.50 low, but the recent action needs to be reversed quickly or we will be stopped out.

Clean Energy (PBW)

PBW is toeing the line here, although it did bounce nicely on the 20 WMA this week and closed out near the highs. We still want to be in this name above $6, but the Relative Strength trend seems to be nearing a failing point. Sometimes this is a warning and other times it corrects itself quickly. This will need to hold these support levels soon if we are going to be able to stay aggressive.

Ford (F)

Ford is in a very similar boat to PBW. The stock is just hanging at the 20 WMA and near price support, while the RS trend is poking through the uptrend. I want to give F the benefit of the doubt but a close below $16.50 with a failing Relative Strength will force me to step aside.

Hain Celestial (HAIN)

On a better note, HAIN once again continues to find buyers near the 20 WMA. For the third time now in this recent uptrend, price has bounced right off that support line. The RS trend is strong and intact and if price could breakout above about $84.65 I would expect another leg higher. That would be a nice place to add to existing positions if you have been looking for a place to increase your HAIN exposure.

Home Depot (HD)

HD is also looking good after a nice bounce back week. With this week's move we now have a new all-time weekly closing high. The RS trend also shows a nice little retest of the breakout before it continued higher. If we get another follow-through week soon, we could move up our stop to the $75 low.

20+ Year Treasury Bond (TLT)

Something that is getting my attention this week is the potential for a Double Bottom formation in the Long Treasury Bond. We saw the previous low from August matched this week, yet price recovered nicely from the lows and momentum is not confirming the same low as price. Momentum is making higher lows since bottoming out back in late June. Nothing has been confirmed here at all and this is still a very early progression in this pattern, but the potential is there for this to begin to evolve into something more.

The pattern will trigger if price breaks above the prior high around $109. If this pattern forms and breaks to the upside it would be time to hedge or reduce your overall market exposure. I would most likely be inclined to buy the breakout in TLT and would thereby hedge my overall market risk. Bonds typically move inverse to stocks, so a positive move in the Bond market would be seen as a likely negative for stocks. If you were holding an 80% stock exposure and added a 20% Bond position, you would effectively reduce your market risk exposure to 60%. The bond position would protect your portfolio by a healthy margin while this pattern was in play.

On a short week like this I really don't have much else for you. I hope you all had a great Thanksgiving and that this review helps you proceed into the seasonally strong month of December.

Saturday, November 30, 2013

Wednesday, November 27, 2013

AAPL Double Bottom target aquired

Our successful position in AAPL has reached our initial price target today. The beginning thesis for our entry was based on the Double Bottom formation from the April and June lows. We have been targeting the $545 area as our place to trim a little gain. Our position has moved nicely since our entry and I am taking half of our position off at this target acquisition. Let's take a look at the setup:

There are a couple interesting factors in play at this level:

1. Price has acquired the double bottom target

2. AAPL is testing the underside of its extended longterm support line (yellow), now turned resistance

3. $545 is the 50% retracement of the decline from AAPL's big selloff last year

4. This is another key inflection point going back to early 2012 and then again in late 2012

This is not an automatic sell here as there still are many positives as well. I like to trim up half of my positions once a major price target is hit, but I can understand if you would like to continue to hold your positions. One could certainly argue that this week's move is a buy signal if we can close the week above $532; it would be the highest weekly close since late last year. You can see also the presence of a cup/handle pattern in progress where the last month's trading action has acted as the breakout and this week is the follow through of that move. So there are still lots of things to like in this space, but after the move we have seen recently and my primary target acquisition, I feel its worth harvesting some gains.

There are a couple interesting factors in play at this level:

1. Price has acquired the double bottom target

2. AAPL is testing the underside of its extended longterm support line (yellow), now turned resistance

3. $545 is the 50% retracement of the decline from AAPL's big selloff last year

4. This is another key inflection point going back to early 2012 and then again in late 2012

This is not an automatic sell here as there still are many positives as well. I like to trim up half of my positions once a major price target is hit, but I can understand if you would like to continue to hold your positions. One could certainly argue that this week's move is a buy signal if we can close the week above $532; it would be the highest weekly close since late last year. You can see also the presence of a cup/handle pattern in progress where the last month's trading action has acted as the breakout and this week is the follow through of that move. So there are still lots of things to like in this space, but after the move we have seen recently and my primary target acquisition, I feel its worth harvesting some gains.

Sunday, November 24, 2013

Weekend Update: New All-Time Highs

US markets closed at new all-time highs again this week with the SP500 closing above 1,800 and the DOW above 16,000. This has been one impressive year for stocks and it still seems like more new highs are ahead. The S&P started out this week pulling back slightly, but then rallied on better than expected jobless claims and closed out at the highs. It is clear that traders are still distrusting and afraid of this market as the slightest thing will cause them to duck and cover. As an example of this, the weakness early on in the week was attributed to a tweet from Carl Icahn suggesting he "feels" that the market will be correcting soon. Now Carl is a legend of an investor, but even he cannot see the future. The important take away here is that we need to focus on the trend and our key support levels instead of comments and jittery traders trying to scare you out of your positions. Usually when someone like Carl says he thinks the market is going to come down, all he is hoping for is for traders to do exactly what they did. He wants them to sell their stocks so HE can buy them at a cheaper price. Comments like this really should have nothing to do with your investments as your plan should be able to ignore the noise.

While its fun to be bullish as heck with these continued new highs, it is important to know that the S&P has been up for the past 7 weeks straight. Just be aware that the markets will go in both directions and even a hefty pullback from here (say down to the 20 WMA) is still very constructive for the longer term trend. A 100 point drop would still just barely test the key uptrend support. While it makes sense that we should see a decent pullback, markets can remain extended much longer than seems reasonable, which is why it is so important to continue to stick with the trend until it fails.

SP500 weekly view

Lets first take a look at our 3 newest positions:

Home Depot (HD)

HD attempted to follow through on its breakout this week, but saw selling in the face of the strength after earnings. This is the second earnings report in a row where they easily beat expectations, yet the stock was sold into the news. It will be interesting to see how this breakout progresses. While this week's trading was disappointing, it is still above the prior swing high and breakout area. Let's see if it can bounce back.

Enbridge (ENB)

ENB has been pulling back the last couple weeks and seems to be retesting the breakout level. While the stock closed just below the 20 WMA, it did manage to find buyers at the $41.50-42 support level. There is not much to worry about at the moment, but we will want to see this week's lows hold and especially we would want it to stay above our $40.50 stop. It is still very early in its bounce back and new moves need to be given time and room to settle out. Considering the magnitude of the 5 year uptrend, you have to be a little more patient with this one, and a more willing to stick with the long term trend.

Wells Fargo (WFC)

Wells and the Financials stayed strong through the week and closed out at the highs. This looks like a nice continuation of the prior uptrend.

And here our some notable charts from our watchlist:

Cummins (CMI)

Here is a perfect example of why its good to strip back your charts and just observe price. By taking out my prior bias and trendlines, I was able to much more clearly see the presence of a very large cup/handle pattern formation. Cummins is in a very interesting spot here; the stock has broken out from a large rounding base and has retested the prior highs on this consolidation. The 20 WMA is also just under the closing price of last week. Relative Strength is soon to be testing its uptrend support as well. All of this together will make CMI a very interesting watch over the next couple weeks to see what will happen next. Is the stock going to resume its breakout and rocket to new all time highs? Or is it going to be a false breakout and roll over? I have an overweight positioning on CMI and will depend on this $128 support level as my tight stop. Based on the prior trend and pattern formation, I am very positive on the stock here and think the risk reward based on Friday's close is about as good as they come.

3D Systems (DDD)

You could say that DDD has an interesting week. After reaching a new all-time high early in the week, the stock got slammed Tuesday and Wednesday and then saw further profit taking on Friday after an attempted bounce back. While the move relative to the prior month's rally is still rather insignificant (price closed at the upper bollinger band), the implication for this type of reversal could be problematic in the near term.

Lets take a look at the prior surge in DDD back at the end of last year:

The initial surge and decline look very similar. We saw quick 6 week rally that extended the stock to the upside and then a high volume breakdown week. After one bounce back the following week, it took the stock 6 more weeks to stabilize. While this week's reversal was not as damaging to the big picture, it could just be the start of a healthy consolidation and correction.

A move back into the $55-60 area will offer a solid risk reward opportunity.

Clean Energy (PBW)

PBW is doing its best to hold the breakout and large support area between $6-6.50. So far so good, but going forward I will be treating the massive support band, 20 WMA and uptrend support as my stop level. I want to be aggressively long above this support zone. And I want to be conservative below the zone.

Apple (AAPL) daily chart

I think AAPL looks great right here. This is another one of my largest current positions. The stock has been consolidating its breakout for about a month now and seems ready to pop. When price breaks through a key resistance level and then cools sideways just above the breakout, there is a high probability that it will continue to the upside once the churn resolves itself. There is a lot of demand for shares here. Above about $510, I am very bullish the stock.

Financials (XLF) daily chart

The Financials continued to push to the upside this week, but we still have not seen the price relative to the SP500 breakout of its downtrend. I still need to see that there is a real trend shift under the surface before I get all on board here. The price is the only thing that pays, but the RS non-confirmation of the higher high in price concerns me that the "real" money is not fully convinced yet. By the way, if this does in fact turn out to be a bull trap situation, that would be VERY bad for the near term direction for the market. We want to see the price relative to the market break from its downtrend and make a higher high as well.

I think that about does it for the week. We are holding many positions currently, yet I feel the market has earned a certain benefit of the doubt. Until we see some real breakdowns, we will need to stay involved in this market.

While its fun to be bullish as heck with these continued new highs, it is important to know that the S&P has been up for the past 7 weeks straight. Just be aware that the markets will go in both directions and even a hefty pullback from here (say down to the 20 WMA) is still very constructive for the longer term trend. A 100 point drop would still just barely test the key uptrend support. While it makes sense that we should see a decent pullback, markets can remain extended much longer than seems reasonable, which is why it is so important to continue to stick with the trend until it fails.

SP500 weekly view

Lets first take a look at our 3 newest positions:

Home Depot (HD)

HD attempted to follow through on its breakout this week, but saw selling in the face of the strength after earnings. This is the second earnings report in a row where they easily beat expectations, yet the stock was sold into the news. It will be interesting to see how this breakout progresses. While this week's trading was disappointing, it is still above the prior swing high and breakout area. Let's see if it can bounce back.

Enbridge (ENB)

ENB has been pulling back the last couple weeks and seems to be retesting the breakout level. While the stock closed just below the 20 WMA, it did manage to find buyers at the $41.50-42 support level. There is not much to worry about at the moment, but we will want to see this week's lows hold and especially we would want it to stay above our $40.50 stop. It is still very early in its bounce back and new moves need to be given time and room to settle out. Considering the magnitude of the 5 year uptrend, you have to be a little more patient with this one, and a more willing to stick with the long term trend.

Wells Fargo (WFC)

Wells and the Financials stayed strong through the week and closed out at the highs. This looks like a nice continuation of the prior uptrend.

And here our some notable charts from our watchlist:

Cummins (CMI)

Here is a perfect example of why its good to strip back your charts and just observe price. By taking out my prior bias and trendlines, I was able to much more clearly see the presence of a very large cup/handle pattern formation. Cummins is in a very interesting spot here; the stock has broken out from a large rounding base and has retested the prior highs on this consolidation. The 20 WMA is also just under the closing price of last week. Relative Strength is soon to be testing its uptrend support as well. All of this together will make CMI a very interesting watch over the next couple weeks to see what will happen next. Is the stock going to resume its breakout and rocket to new all time highs? Or is it going to be a false breakout and roll over? I have an overweight positioning on CMI and will depend on this $128 support level as my tight stop. Based on the prior trend and pattern formation, I am very positive on the stock here and think the risk reward based on Friday's close is about as good as they come.

3D Systems (DDD)

You could say that DDD has an interesting week. After reaching a new all-time high early in the week, the stock got slammed Tuesday and Wednesday and then saw further profit taking on Friday after an attempted bounce back. While the move relative to the prior month's rally is still rather insignificant (price closed at the upper bollinger band), the implication for this type of reversal could be problematic in the near term.

Lets take a look at the prior surge in DDD back at the end of last year:

The initial surge and decline look very similar. We saw quick 6 week rally that extended the stock to the upside and then a high volume breakdown week. After one bounce back the following week, it took the stock 6 more weeks to stabilize. While this week's reversal was not as damaging to the big picture, it could just be the start of a healthy consolidation and correction.

A move back into the $55-60 area will offer a solid risk reward opportunity.

Clean Energy (PBW)

PBW is doing its best to hold the breakout and large support area between $6-6.50. So far so good, but going forward I will be treating the massive support band, 20 WMA and uptrend support as my stop level. I want to be aggressively long above this support zone. And I want to be conservative below the zone.

Apple (AAPL) daily chart

I think AAPL looks great right here. This is another one of my largest current positions. The stock has been consolidating its breakout for about a month now and seems ready to pop. When price breaks through a key resistance level and then cools sideways just above the breakout, there is a high probability that it will continue to the upside once the churn resolves itself. There is a lot of demand for shares here. Above about $510, I am very bullish the stock.

Financials (XLF) daily chart

The Financials continued to push to the upside this week, but we still have not seen the price relative to the SP500 breakout of its downtrend. I still need to see that there is a real trend shift under the surface before I get all on board here. The price is the only thing that pays, but the RS non-confirmation of the higher high in price concerns me that the "real" money is not fully convinced yet. By the way, if this does in fact turn out to be a bull trap situation, that would be VERY bad for the near term direction for the market. We want to see the price relative to the market break from its downtrend and make a higher high as well.

I think that about does it for the week. We are holding many positions currently, yet I feel the market has earned a certain benefit of the doubt. Until we see some real breakdowns, we will need to stay involved in this market.

Friday, November 22, 2013

Entering Wells Fargo (WFC)

Since our exit signal in WFC the stock has recovered nicely. As is the case with trend following signals, sometimes you sell the lows and buy the highs, it's just part of the game. The purpose of a trend following strategy is not to catch every top or bottom and trade violently. A trend following strategy is designed to catch most of the large rallies and avoid most of the big sell offs. When risk outweighs reward is when we sell and reduce exposure. When the situation is more positive, we buy and increase positions. That's why you sometimes end up selling the lows and buying he highs. It's only when a stock breaks through an important support that you risk a significant part of your capital. When a stock is trending higher and consistently making higher lows is when you are at less risk. It is only when that trend shifts to lower lows that your risk increases substantially. Again, you won't sell at the top or buy at the bottom with a trend following plan, but you will be able to side step large bearish trending markets early on in the transition.

It surprises most average investors when you tell them the '08 crash took 6 months from top to bottom. Most feel like it only takes one day and all your money can be gone, when that simply isn't the case. Following a simple trend following strategy signaled exits on multiple occasions during that decline. While it is true that most lower lows don't turn into '08 style corrections, the point is when in the moment without hindsight as your guide, you MUST treat every breakdown exactly the same. That way you will know that no matter what, if you stick to your plan you will never get caught in a full market meltdown. And that is how you win with the market; avoid the big catastrophic draw downs to your accounts, the kind you need a second job to overcome. It is not necessary to maintain 100% market exposure to achieve decent returns, as I have shown through our short time together so far. With you always be right? No, and not likely close. If you can lets big trends run and cut losing positions fast, you don't even need to be right 50% of the time and be successful. So be sure to take into consideration the long run. I don't intend on this being a one year blog. I hope to be doing this for decades to come. Stick with the plan and we will see some surprising results.

Okay, lesson over. We have a new signal. WFC has broken the prior swing high and is now looking to challenge all-time highs. There are a couple things to look at here:

First we have a reversal Head/Shoulder pattern triggered with the new higher high. The pattern is smallish, but it suggests a resumption of the prior uptrend. The target is roughly $48.

We also can see Relative Strength confirm the short term trend change.

Daily Chart 1-year

Weekly 3-year

On the weekly view, we can tighten up the trend line and add the recent pullback low to our list of significant trend line touches. A good place for our initial stop will be below the right shoulder just about $40. That will tell us the breakout was false, it would break the 20 WMA and uptrend support, and that a longer consolidation/correction is needed.

It surprises most average investors when you tell them the '08 crash took 6 months from top to bottom. Most feel like it only takes one day and all your money can be gone, when that simply isn't the case. Following a simple trend following strategy signaled exits on multiple occasions during that decline. While it is true that most lower lows don't turn into '08 style corrections, the point is when in the moment without hindsight as your guide, you MUST treat every breakdown exactly the same. That way you will know that no matter what, if you stick to your plan you will never get caught in a full market meltdown. And that is how you win with the market; avoid the big catastrophic draw downs to your accounts, the kind you need a second job to overcome. It is not necessary to maintain 100% market exposure to achieve decent returns, as I have shown through our short time together so far. With you always be right? No, and not likely close. If you can lets big trends run and cut losing positions fast, you don't even need to be right 50% of the time and be successful. So be sure to take into consideration the long run. I don't intend on this being a one year blog. I hope to be doing this for decades to come. Stick with the plan and we will see some surprising results.

Okay, lesson over. We have a new signal. WFC has broken the prior swing high and is now looking to challenge all-time highs. There are a couple things to look at here:

First we have a reversal Head/Shoulder pattern triggered with the new higher high. The pattern is smallish, but it suggests a resumption of the prior uptrend. The target is roughly $48.

We also can see Relative Strength confirm the short term trend change.

Daily Chart 1-year

Weekly 3-year

On the weekly view, we can tighten up the trend line and add the recent pullback low to our list of significant trend line touches. A good place for our initial stop will be below the right shoulder just about $40. That will tell us the breakout was false, it would break the 20 WMA and uptrend support, and that a longer consolidation/correction is needed.

Saturday, November 16, 2013

Weekend Update: More Chart Porn and the XLF

This week was a nice continuation of the rally. The SP500 closed at a new all-time high this week and seems to be on track to continue gains into the year end (even though many expect that to be the case). It is interesting to me that there is such a continued disbelief in the market as a whole from the "every man". They know its going up now and realize they have missed a huge opportunity, but are not about to go jumping into it now...They're gonna wait for it to come down. The media has been pumping out all kinds of investor sentiment data suggesting major euphoria in the markets right here and how a larger correction is absolutely imminent. Frankly I just don't see it. During times of market tops, CNBC isn't talking about a bubble in stock prices in almost every interview they conduct. If you tune into the major financial media outlets it won't take more than 10 minutes before a "bubble" is being talked about. Even the auxiliary financial reporting (blogs from traders/investors) are talking about how ludicrous it is that all this bubble talk is. There's a bubble about bubbles.

Listen, bubbles don't occur when everyone is talking about and looking for them. That's the whole point of a bubble; it is an irrational, frantic investing landscape and nobody sees it happening until after the fact.

What is one mans bubble, is another man's 3rd wave rally I guess. Because in terms of my sentiment feelings we are in about that stage of a 5 wave move. The 3rd impulse wave, which tends to be the longest of the 1,3 and 5 primary wave patterns, is the "confidence" wave. The participants are starting to get more comfortable with their market exposure and look to take advantage of any opportunity in front of them (that is, real traders and investors, not the news folks)...Very much a buy-the-dip mentality, which is highly supportive of stock prices in the intermediate term. Will there be a pullback? a real enough one that gets the Bears all frothy and then blows them out of the water? Yes and that would be the expected 4th wave correction. Which would lead to inevitably the 5th wave surge. That's the one the CNBC minions will laud as the "market than never will go down. How can it?" And that's when the top is near. Not here in "bubble world", but in "the market always just goes up" world. We aren't there yet. Absolutely nothing in my study of price action suggests that we are nearing a crash.

It should be a little uneasy putting money to work at new highs. You're suppose to buy low, right? I am of the belief that if you are making a stock purchase and it doesn't make you a tiny bit queasy, then its likely not a good purchase. The ones you buy and you go, "oh man, that one could burn me", those become the best ones. Of course opportunities come from all areas of the markets. They come from lows, they come from highs. You just simply need to use your signals and follow that as your guide. Don't follow some financial analyst on tv, or your buddy's hot stock tip. Get a plan, get a signal and take it. Regardless of how much "sense" it makes to do so at new market highs.

SP500 weekly view

These are the dominant lines for the SP500 on the intermediate timeframe as I see it. Since our little nude chart show last weekend, these are the lines that seem most relevant to me for the health and success of this rally. You really need to be in this market above both these lines. I would say reduce some exposure on a failure of the upper line to hold as support and finally exit when the lower uptrend support goes. I would want to be VERY conservative below that level. That will be the 4th wave move I discussed above. A break of the uptrend support of the last years move, will be a secondary, counter trend correction.

That will be a dip to be bought and then will lead into the final stages of the Secular bull market. That move could last years. It could be the great move of our generation. I'm 30 years old and it would be perfectly reasonable to see when I'm 50 the ending to this bull market. That's 20 years, and when you look at history, these have not been impossible events. We have seen bull markets like this as new generations take the lead in the economy and drive growth higher. I am the "child of the Baby-Boomers", this will be a big generation for America. That's a very, very long term outlook, but that's the kind of thing I'm thinking about...Shorter term, watch these lines!

Big rants today, sorry all! Got to be done sometimes. It's more brain spew for me, because I will guarantee you, I use this blog more than all of my readers combined...easily. It is my weekly historical reference for the markets. It is a huge help. Thank you all for indulging me. I hope you can gain something from my efforts.

Lets look at some of our big trends this year...Stripped down, pure price.

Home Depot (HD) daily chart 1-year

Welcome back to the Portfolio HD! We entered a new position this week in Home Depot after it was able to make a higher high, breaking out of the 3-month trading range its been in. After a torrid start to the year, HD has taken a nice break without doing ANY technical damage to its long term up move. I believe the trend is setting up to continue and a break below $72 will prove me wrong.

Cummins (CMI)

Cummins has seen fits and starts this year. It started the rally nicely with an almost 30% gain, then it consolidated from Feb-Aug. It has since been continuing higher from the June lows, and despite a little hiccup in October, the uptrend is intact. Our stop is still at the $122 support and now key swing low.

Ford (F)

We have had a great run in Ford this year as it is up 70% from the November lows. We have seen some tough sledding for the past 5 months and I expect it to continue to be range bound between $19 and $16ish for the intermediate term. A breakout above $19 would be fantastic, a breakdown of $15 would be highly damaging. Right now we are stuck in the middle with a Half sized position...okay place to be as long as the longer term trend holds up.

Wells Fargo (WFC)

Wells and all the banks had a stellar first half of the year last year. But since the summer peak, prices have meandered toward the bottom right hand corner of the chart. Nothing major or even negative really, just a rest. It appears that the rest could be nearing an end soon. If WFC could break above the ~$44 level, it would set into motion a nice looking reversal setup here between $40 and $44. The key point for Wells right here is the swing low in early October at about $40. We will look to reenter a position on a breakout above $44 with confirming signals.

Clean Energy (PBW)

What a winner Clean Energy has been this year. This is one of my favorite picks. Up just under 100% since the November low, PBW has been able to continuously make new highs and show positive price action. It looks as though a short term swing point will occur soon as price has been tightening in a triangle/pennant formation since mid-October. A break of $6.25 to the downside will cause shares to come under pressure likely down to the $5.50-$5.75 level. While a break above the $6.90ish area will continue to rally to new multi-year highs. I know that sounds obvious, but most of this price following is that simple. If it goes up, it goes up and if it goes down, it goes down. Its just our job to best align ourselves with that process.

3D Systems (DDD)

If Clean Energy was one of our favorite picks this year, DDD has to be THE pick of the year! This thing has been an absolute monster for my accounts over the past 8 months and up over 200% since the November lows. I was buying the trend shift in mid-April and have stuck with it all the way up. We made our entry for the Portfolio in July @ $51 per share and as of last week we sold half of that position. Price has since continued to rip, up another $10 this week! While it would have been nice to really get all of that gain, I am perfectly fine riding a 50% position at these levels. If it keeps going up, at least we are along for the ride, when it pulls back reasonably and sets up again, we will align with that new setup. For now we are taking what its giving us and that is still very solid returns at half our initial risk.

Enbridge (ENB)

Since running strongly into year end and early spring, Enbridge has been beaten up a bit on this shorter term timeframe. If you take a look at the uptrend in place from the '09 lows nothing really has changed here. Price is just now bouncing off the range and channel lows and seems ready to continue the strong push higher. We saw a nice breakout 2 weeks ago as price rallied through the downtrend resistance and took out the $43 level that I have been watching closely. This week we saw a smooth pullback to retest that breakout and have entered our first position for the Portfolio this year in ENB. We will use the prior 3 lows from around the $40 level as our invalidation point on this entry. I love to buy this stock as it comes into trend support. It has been a winner for me for the past couple years. Keep riding these big trends.

PPG (PPG)

PPG is a beast. This thing just goes higher. When it dips, it dips smoothly and orderly. It then sets up nicely each time and breaks out in a text book manner. This is a great place to manage some of your funds. Big winners that act like this are hard to come by. Stick with it above $160

Hain Celestial (HAIN)

Ah HAIN. One of my other favs. I have been all over this stock for a couple years now and it is just a nice stock to trade. What we have seen this year has been stellar. The stock is up a cool 60% from the January lows and looks like its wants to continue to push higher. They continue to roll out quarter after quarter of record profits and sales...yes this is the one company where I actually listen to the conference calls. When a company (who's products I use a ton of) continues to act this well, has a very sharp CEO and a stock price like this...What's not to like?

The other funny thing about this chart is that the prior pop and drop are not even shown here in the 1-year view. This thing everyone thought was topped out mid last year and yet it just bases, breaks out and follows through time after time. Love it! Big support at $72

Apple (AAPL)

After that fantastic decline, we have seen AAPL put in a very nice looking Rounding Bottom. As you well know, we have been positioned aggressively bullish in this stock since the $460 breakout, from the 1st week in August. This chart looks very constructive to me and the momentum is starting to build up. If they follow through with Carl Icahn's share repurchase suggestion, I think this easily moves back to the prior highs. If we can see a sustained breakout above the $540 area we would move up our trailing stop to just below this weeks low at about $510. But we still need to see more for that to happen anytime soon. Currently we will be invalidated right near our $460 entry position. We basically have a zero risk position in AAPL here...That's a nice feeling! Especially with such a bullish setup in the price action.

---

The only thing else I really wanted to touch on this week was that we are moments away from getting a new buy signal in the Financials (XLF). Currently the XLF and XLU are our only S&P sector groups where we have no active position. Both are very close to buy signals and I'm not sure I have ever had buys on EVERY sector group simultaneously, that would be interesting in deed. None the less, the XLF has setup for a nice breakout should we see a little more confirmation in the near future.

Financials (XLF)

While we have seen price take out the prior highs this week, I didn't get any confirmation from the secondary indicators. Trading volume was weaker this week than it was last week and we always like to see volume pick up on a breakout signal, not decrease. And secondly, the Relative Strength trend has not been able to confirm the breakout. This could be signaling a false move under the surface as traders are not fully committed to this move just yet. I hope to see some confirming signals soon and will be able to act on these new price highs. So this is something to keep on the close watch list going forward. Remember that the market likes to follow the Financials in whatever direction they take.

Listen, bubbles don't occur when everyone is talking about and looking for them. That's the whole point of a bubble; it is an irrational, frantic investing landscape and nobody sees it happening until after the fact.

What is one mans bubble, is another man's 3rd wave rally I guess. Because in terms of my sentiment feelings we are in about that stage of a 5 wave move. The 3rd impulse wave, which tends to be the longest of the 1,3 and 5 primary wave patterns, is the "confidence" wave. The participants are starting to get more comfortable with their market exposure and look to take advantage of any opportunity in front of them (that is, real traders and investors, not the news folks)...Very much a buy-the-dip mentality, which is highly supportive of stock prices in the intermediate term. Will there be a pullback? a real enough one that gets the Bears all frothy and then blows them out of the water? Yes and that would be the expected 4th wave correction. Which would lead to inevitably the 5th wave surge. That's the one the CNBC minions will laud as the "market than never will go down. How can it?" And that's when the top is near. Not here in "bubble world", but in "the market always just goes up" world. We aren't there yet. Absolutely nothing in my study of price action suggests that we are nearing a crash.

It should be a little uneasy putting money to work at new highs. You're suppose to buy low, right? I am of the belief that if you are making a stock purchase and it doesn't make you a tiny bit queasy, then its likely not a good purchase. The ones you buy and you go, "oh man, that one could burn me", those become the best ones. Of course opportunities come from all areas of the markets. They come from lows, they come from highs. You just simply need to use your signals and follow that as your guide. Don't follow some financial analyst on tv, or your buddy's hot stock tip. Get a plan, get a signal and take it. Regardless of how much "sense" it makes to do so at new market highs.

SP500 weekly view

These are the dominant lines for the SP500 on the intermediate timeframe as I see it. Since our little nude chart show last weekend, these are the lines that seem most relevant to me for the health and success of this rally. You really need to be in this market above both these lines. I would say reduce some exposure on a failure of the upper line to hold as support and finally exit when the lower uptrend support goes. I would want to be VERY conservative below that level. That will be the 4th wave move I discussed above. A break of the uptrend support of the last years move, will be a secondary, counter trend correction.

That will be a dip to be bought and then will lead into the final stages of the Secular bull market. That move could last years. It could be the great move of our generation. I'm 30 years old and it would be perfectly reasonable to see when I'm 50 the ending to this bull market. That's 20 years, and when you look at history, these have not been impossible events. We have seen bull markets like this as new generations take the lead in the economy and drive growth higher. I am the "child of the Baby-Boomers", this will be a big generation for America. That's a very, very long term outlook, but that's the kind of thing I'm thinking about...Shorter term, watch these lines!

Big rants today, sorry all! Got to be done sometimes. It's more brain spew for me, because I will guarantee you, I use this blog more than all of my readers combined...easily. It is my weekly historical reference for the markets. It is a huge help. Thank you all for indulging me. I hope you can gain something from my efforts.

Lets look at some of our big trends this year...Stripped down, pure price.

Home Depot (HD) daily chart 1-year

Welcome back to the Portfolio HD! We entered a new position this week in Home Depot after it was able to make a higher high, breaking out of the 3-month trading range its been in. After a torrid start to the year, HD has taken a nice break without doing ANY technical damage to its long term up move. I believe the trend is setting up to continue and a break below $72 will prove me wrong.

Cummins (CMI)

Cummins has seen fits and starts this year. It started the rally nicely with an almost 30% gain, then it consolidated from Feb-Aug. It has since been continuing higher from the June lows, and despite a little hiccup in October, the uptrend is intact. Our stop is still at the $122 support and now key swing low.

Ford (F)

We have had a great run in Ford this year as it is up 70% from the November lows. We have seen some tough sledding for the past 5 months and I expect it to continue to be range bound between $19 and $16ish for the intermediate term. A breakout above $19 would be fantastic, a breakdown of $15 would be highly damaging. Right now we are stuck in the middle with a Half sized position...okay place to be as long as the longer term trend holds up.

Wells Fargo (WFC)

Wells and all the banks had a stellar first half of the year last year. But since the summer peak, prices have meandered toward the bottom right hand corner of the chart. Nothing major or even negative really, just a rest. It appears that the rest could be nearing an end soon. If WFC could break above the ~$44 level, it would set into motion a nice looking reversal setup here between $40 and $44. The key point for Wells right here is the swing low in early October at about $40. We will look to reenter a position on a breakout above $44 with confirming signals.

Clean Energy (PBW)

What a winner Clean Energy has been this year. This is one of my favorite picks. Up just under 100% since the November low, PBW has been able to continuously make new highs and show positive price action. It looks as though a short term swing point will occur soon as price has been tightening in a triangle/pennant formation since mid-October. A break of $6.25 to the downside will cause shares to come under pressure likely down to the $5.50-$5.75 level. While a break above the $6.90ish area will continue to rally to new multi-year highs. I know that sounds obvious, but most of this price following is that simple. If it goes up, it goes up and if it goes down, it goes down. Its just our job to best align ourselves with that process.

3D Systems (DDD)

If Clean Energy was one of our favorite picks this year, DDD has to be THE pick of the year! This thing has been an absolute monster for my accounts over the past 8 months and up over 200% since the November lows. I was buying the trend shift in mid-April and have stuck with it all the way up. We made our entry for the Portfolio in July @ $51 per share and as of last week we sold half of that position. Price has since continued to rip, up another $10 this week! While it would have been nice to really get all of that gain, I am perfectly fine riding a 50% position at these levels. If it keeps going up, at least we are along for the ride, when it pulls back reasonably and sets up again, we will align with that new setup. For now we are taking what its giving us and that is still very solid returns at half our initial risk.

Enbridge (ENB)

Since running strongly into year end and early spring, Enbridge has been beaten up a bit on this shorter term timeframe. If you take a look at the uptrend in place from the '09 lows nothing really has changed here. Price is just now bouncing off the range and channel lows and seems ready to continue the strong push higher. We saw a nice breakout 2 weeks ago as price rallied through the downtrend resistance and took out the $43 level that I have been watching closely. This week we saw a smooth pullback to retest that breakout and have entered our first position for the Portfolio this year in ENB. We will use the prior 3 lows from around the $40 level as our invalidation point on this entry. I love to buy this stock as it comes into trend support. It has been a winner for me for the past couple years. Keep riding these big trends.

PPG (PPG)

PPG is a beast. This thing just goes higher. When it dips, it dips smoothly and orderly. It then sets up nicely each time and breaks out in a text book manner. This is a great place to manage some of your funds. Big winners that act like this are hard to come by. Stick with it above $160

Hain Celestial (HAIN)

Ah HAIN. One of my other favs. I have been all over this stock for a couple years now and it is just a nice stock to trade. What we have seen this year has been stellar. The stock is up a cool 60% from the January lows and looks like its wants to continue to push higher. They continue to roll out quarter after quarter of record profits and sales...yes this is the one company where I actually listen to the conference calls. When a company (who's products I use a ton of) continues to act this well, has a very sharp CEO and a stock price like this...What's not to like?

The other funny thing about this chart is that the prior pop and drop are not even shown here in the 1-year view. This thing everyone thought was topped out mid last year and yet it just bases, breaks out and follows through time after time. Love it! Big support at $72

Apple (AAPL)

After that fantastic decline, we have seen AAPL put in a very nice looking Rounding Bottom. As you well know, we have been positioned aggressively bullish in this stock since the $460 breakout, from the 1st week in August. This chart looks very constructive to me and the momentum is starting to build up. If they follow through with Carl Icahn's share repurchase suggestion, I think this easily moves back to the prior highs. If we can see a sustained breakout above the $540 area we would move up our trailing stop to just below this weeks low at about $510. But we still need to see more for that to happen anytime soon. Currently we will be invalidated right near our $460 entry position. We basically have a zero risk position in AAPL here...That's a nice feeling! Especially with such a bullish setup in the price action.

---

The only thing else I really wanted to touch on this week was that we are moments away from getting a new buy signal in the Financials (XLF). Currently the XLF and XLU are our only S&P sector groups where we have no active position. Both are very close to buy signals and I'm not sure I have ever had buys on EVERY sector group simultaneously, that would be interesting in deed. None the less, the XLF has setup for a nice breakout should we see a little more confirmation in the near future.

Financials (XLF)

While we have seen price take out the prior highs this week, I didn't get any confirmation from the secondary indicators. Trading volume was weaker this week than it was last week and we always like to see volume pick up on a breakout signal, not decrease. And secondly, the Relative Strength trend has not been able to confirm the breakout. This could be signaling a false move under the surface as traders are not fully committed to this move just yet. I hope to see some confirming signals soon and will be able to act on these new price highs. So this is something to keep on the close watch list going forward. Remember that the market likes to follow the Financials in whatever direction they take.

Friday, November 15, 2013

Entering Home Depot (HD)

We have received a new buy signal on Home Depot. As you recall we were stopped out of our previously successful position in HD in mid-August (post here). It has taken a couple months, but the stock has stabilized and has been able to signal a resumption of the prior uptrend.

Here is the Weekly view, of course. This is showing price breakout of the coiling triangle pattern, with increased volume this week and a confirmation from the Relative Strength trend that shows a breakout relative to the market as well.

This is what we hope happens when we exit a strong position; we want to see the price consolidate and slow down after such a rapid increase in value. We also like to see, regardless of our sell signal, that the underlying bid for the stock is strong enough to allow it to set again quickly. What we DON'T like to see after an exit signal is a sharp and brutal decline. That signals more trouble ahead and that there is something definitely wrong and out of balance. But a smooth, orderly correction or churning gives us a fantastic new base to launch our next position off of.

As of our entry today, we will use the prior low and horizontal support at $72 for our stop. That stop is about 10% away from the current price, which gives us a nice cushion to trade against. As this progresses higher we will be able to tighten up that stop a bit.

Here is the Weekly view, of course. This is showing price breakout of the coiling triangle pattern, with increased volume this week and a confirmation from the Relative Strength trend that shows a breakout relative to the market as well.

This is what we hope happens when we exit a strong position; we want to see the price consolidate and slow down after such a rapid increase in value. We also like to see, regardless of our sell signal, that the underlying bid for the stock is strong enough to allow it to set again quickly. What we DON'T like to see after an exit signal is a sharp and brutal decline. That signals more trouble ahead and that there is something definitely wrong and out of balance. But a smooth, orderly correction or churning gives us a fantastic new base to launch our next position off of.

As of our entry today, we will use the prior low and horizontal support at $72 for our stop. That stop is about 10% away from the current price, which gives us a nice cushion to trade against. As this progresses higher we will be able to tighten up that stop a bit.

Thursday, November 14, 2013

Entering Enbridge (ENB)

With multiple breakout signals and strong support in place, it is time to re-enter Enbridge (ENB). This has been a fantastic trend for several years and so far the recent correction has simply moved price from the top of the range down to the bottom. There is a very strong support band in place between $42 and $39 from the 8-month trading range in Mid 2012; prices have recently tested this support band, as well as the 4 1/2 year uptrend support. This anchored support zone gives us a very clear invalidation point to our entry and a low risk way to continue following this monster trend. With big trends like this, you want to be a buyer at the bottom of the channel and a seller at the top. Buy support, sell resistance. That is what we have done in the past and will look to do this time as well.

Along with the support base to trade against, we seem to be seeing some positive momentum come into the stock here as well. There has been a heavy accumulation of shares over the past month as price has tested those support levels. This shows institutional investor interest at these levels and that helps provide a floor under the price. ENB has broken above the 6-month downtrend resistance and seen nice follow through after the breakout, as well as heavier than normal trade volume (which signifies more confidence in the breakout). The last six trading days have not been kind to the stock, but have been kind to our entry level. We are now seeing prices pullback into the rising 20 WMA and it offers a great place to buy some shares.

If the stock fails to hold this downtrend breakout and the support zone is broken, we will step aside.

Long term uptrend intact and looks poised for another leg higher.

Closer look at breakout and support levels. Buy volume has been very strong the past 2 weeks.

Along with the support base to trade against, we seem to be seeing some positive momentum come into the stock here as well. There has been a heavy accumulation of shares over the past month as price has tested those support levels. This shows institutional investor interest at these levels and that helps provide a floor under the price. ENB has broken above the 6-month downtrend resistance and seen nice follow through after the breakout, as well as heavier than normal trade volume (which signifies more confidence in the breakout). The last six trading days have not been kind to the stock, but have been kind to our entry level. We are now seeing prices pullback into the rising 20 WMA and it offers a great place to buy some shares.

If the stock fails to hold this downtrend breakout and the support zone is broken, we will step aside.

Long term uptrend intact and looks poised for another leg higher.

Closer look at breakout and support levels. Buy volume has been very strong the past 2 weeks.

Sunday, November 10, 2013

Weekend Update: Chart Porn

It is an incredibly positive practice, good for the soul and the heart, to once in a while look at some chart porn. CHART PORN!? What the hell is that? Once you see chart porn it will change your perspective forever. Most every stock chart you will see will have distracting stuff all over it: indicators, lines, price containing bands, boxes, colors, you name it. It's very prudish chart dress up if you ask me. What we really want are charts exposed, in the nude, with nothing on them...You know, chart porn.

When all you have is price by itself you are left with the pure, unadulterated trend and direction. When there are channel lines and momentum indicators on your charts, you will have biases to your analysis. "Well I can't buy this breakout signal, there's a channel line there", or "that tanking stock has positive momentum, I should buy it". Whatever the setup shows, your perception of the price will be altered by the indicators. Not to say that those things can't be helpful, because they certainly can (in small doses), but price trend is still the most important factor and sometimes that gets lost in search of the magic indicator.

So lets get to it! Lets look at some chart porn!

For the sake of this exercise we are going to look at 1-year, daily bar charts to make sure we are seeing the most recent and relevant price trend. It is a good idea to look at all perspectives and time frames, but for everyone's patience and attention I'm just gonna stick to one, intermediate term view. We will look at the Sector groups this week and next week we will look at our Top 10 stocks.

---Note: erasing old lines and stripping your charts bare, will prove helpful for practice in identifying support/resistance levels and possibly open your view to some things you may have missed by only focusing on older trend lines and levels. Markets are always changing and evolving, so its a good idea to wipe the slate clean from time to time and redraw the most relevant levels.

SP500

So here is a full nude of the SP500 index for the past year. This will be the primary comparison chart for the rest of our trends. We are looking for higher highs and higher lows, steepness of trend, new highs, and breakouts. As you can see by looking at the SP500 price movement here we have higher highs and higher lows (uptrend), about a 45-55 degree slope (45 degrees is steady and sustainable), there are certainly new highs being made in the last surge, and a new breakout that has so far held.

Picture perfect, yes? Now we will compare this chart to the 9 sector groups that comprise the SP500 and see how the Offensive groups stack up vs the Defensives.

Offensive Groups

Financials (XLF)

The XLF was nearly identical to the SP500 through the August peak. Since that point however they have failed to reach new highs on subsequent rallies. The one main thing that stands out to me still though is that no new low has passed the previous low, therefore the primary uptrend is still intact. Relative strength is lagging by not being able to reach new highs along with the broad market, but a breakout above the $21 highs should confirm higher prices to come. If the XLF can take out those highs, I would expect another leg up in this rally.

Discretionary (XLY)

This is what a true leader looks like! Discretionary has been just humming along, look at that uptrend. New highs on each rally and a very strong breakout above the prior highs. This is still the front runner for sector of the year in my mind. I had and do have a lot of exposure to the XLY stocks; I think they represent the most constructive sector in the market.

Technology (XLK)

Tech has come on strong over the past six weeks or so. Price has maintained an uptrend throughout the year, but only recently has the group been leading the market. For almost the entire up move this year, Tech leadership was largely absent. I am of the belief that Tech could really make a strong push from around these levels and lead the market in a year end rally. The gap and go breakout in mid-October looks strong for the near term prospects of the group.

Industrials (XLI)

Industrials have been great. The relative strength of the group has been very strong since May when they experienced a gap and go breakout. There was a nice correction after that strong initial rally (it filled the gap from the May breakout almost to the penny), but that just set the stage for an even stronger leg up from July to November. New highs, higher lows. This is a winner.

Materials (XLB)

Materials keep looking like they want to do something big, but are sure taking their time getting there. They are still holding up fine and performing in line with the S&P. We certainly have a decent uptrend and after seeing strong action on Friday, I hope this will step up the pace a bit. The rally from October, that has now slowly corrected, looks to have formed a bull flag pattern and a break above $44.40 would set up another leg higher.

Energy (XLE)

Energy is in the same boat as Materials. Every time you think its about to start moving again, it stalls a bit. Its a choppy uptrend, but we still continue to see new highs none the less. Even though its been sloppy recently, you could make the case that it too is setting up a bull flag type pattern and is looking to extend its new highs streak a little longer. With oil coming down in price pretty drastically over the past two months, I think its due for a bounce, which would also help the group as a whole push to new highs.

------

Defensive Groups

Health Care (XLV)

The strongest of the Defensive groups, Health Care has been a source of market strength all year long. It has consistently made new highs and is holding its most recent breakout very well. I have been seeing a lot of the individual names within the XLV show strong breakouts as well. This still looks like a winner.

Staples (XLP)

The Staples have underperformed significantly since topping out in May. The first half of the year run was epic; there were barely more than a handful of down days over a 6 month period! But since that rally, price has really consolidated those gains and took a lot of the froth out of the group. As we have discussed recently, the XLP looks to be signaling that it wants to continue it previous move higher from this long sideways base. The breakout over the last couple weeks has held and as long as prices can hold these new highs, this thing has a chance to duplicate its January-June momentum.

Utilities (XLU)

Utilities look like an even sloppier version of the Staples. I actually got a false entry signal in XLU on Thursday, but then promptly exited the position at the end of the day Friday, when my breakout signal rolled over and failed. I think these are close to setting up a nice risk reward, but its still just a bit too soon to get fully on board.

20+ Year Treasuries (TLT)

As the primary "anti-stocks" asset class, long term Treasury Bonds have been slaughtered all year. The only meaningful rally occurred over a 2 month period from March to May, but certainly has the look of a secondary move against the primary down trend. The consolidation from August to now has a very similar feel and Friday's gap down through the short-term uptrend support shows more weakness is likely. This could be setting up two bearish looking patterns. The most recent bounce looks to have formed the flag portion of a continuation bear flag pattern, and also Friday appears to be a gap and go to the downside. Stocks gap up, Bonds gap down. Stocks press against new highs, Bonds press against new lows. The top in Stocks is not in, the bottom in Bonds is not in.

Gold (GLD)

The "fear gauge", the "end of the world" trade, Gold has gotten crushed this year. Gold tried to stabilize and rally back from the July low, but was unable to take out the $138 high from June and has since continued lower. I did have some interest in this setting up to break the downtrend, but any reversal attempt is taking longer than it should for a strong reversal. This just simply needs more time and there are clearly better places to put your money at this point.

The whole point of what I'm trying to do here is show how you can use the behavior of price to avoid the weakest and more high risk areas of the market. At the same time, identifying where the strength and relative performance in the market is. By looking simply at price you can see what is working and what isn't. That's the name of this game: Put your money into the places that are working, not the ones who are failing to keep up.

If you had a typical "asset allocation" portfolio model, at the age of 50 (which would likely mean roughly a 50% stock, 40% bonds, and 10% Gold), the typical mutual fund or 401k strategy would have half of your money tied up in these two horrible preforming asset classes. This "diversification" has not only cost you a significant loss on half of your investments, it takes away from the gains you have seen in your correctly positioned stock exposure.

I'm trying to help people see the returns that are possible and the very small amount of risk it takes to acquire those returns. With those "buy and hold", asset allocation models, you maintain 100% market exposure at all times. Are those kinds of returns worth 100% risk? With a trend following strategy you are never exposed to the large scale crashes because your trend signals invalidate before the bottom falls out. With a simple online brokerage account you can safely and successfully manage AT LEAST a portion of your investment savings with this simple trend following strategy.

This stuff is not magic, folks...Its Chart Porn!

When all you have is price by itself you are left with the pure, unadulterated trend and direction. When there are channel lines and momentum indicators on your charts, you will have biases to your analysis. "Well I can't buy this breakout signal, there's a channel line there", or "that tanking stock has positive momentum, I should buy it". Whatever the setup shows, your perception of the price will be altered by the indicators. Not to say that those things can't be helpful, because they certainly can (in small doses), but price trend is still the most important factor and sometimes that gets lost in search of the magic indicator.

So lets get to it! Lets look at some chart porn!

For the sake of this exercise we are going to look at 1-year, daily bar charts to make sure we are seeing the most recent and relevant price trend. It is a good idea to look at all perspectives and time frames, but for everyone's patience and attention I'm just gonna stick to one, intermediate term view. We will look at the Sector groups this week and next week we will look at our Top 10 stocks.

---Note: erasing old lines and stripping your charts bare, will prove helpful for practice in identifying support/resistance levels and possibly open your view to some things you may have missed by only focusing on older trend lines and levels. Markets are always changing and evolving, so its a good idea to wipe the slate clean from time to time and redraw the most relevant levels.

SP500

So here is a full nude of the SP500 index for the past year. This will be the primary comparison chart for the rest of our trends. We are looking for higher highs and higher lows, steepness of trend, new highs, and breakouts. As you can see by looking at the SP500 price movement here we have higher highs and higher lows (uptrend), about a 45-55 degree slope (45 degrees is steady and sustainable), there are certainly new highs being made in the last surge, and a new breakout that has so far held.

Picture perfect, yes? Now we will compare this chart to the 9 sector groups that comprise the SP500 and see how the Offensive groups stack up vs the Defensives.

Offensive Groups

Financials (XLF)

The XLF was nearly identical to the SP500 through the August peak. Since that point however they have failed to reach new highs on subsequent rallies. The one main thing that stands out to me still though is that no new low has passed the previous low, therefore the primary uptrend is still intact. Relative strength is lagging by not being able to reach new highs along with the broad market, but a breakout above the $21 highs should confirm higher prices to come. If the XLF can take out those highs, I would expect another leg up in this rally.

Discretionary (XLY)

This is what a true leader looks like! Discretionary has been just humming along, look at that uptrend. New highs on each rally and a very strong breakout above the prior highs. This is still the front runner for sector of the year in my mind. I had and do have a lot of exposure to the XLY stocks; I think they represent the most constructive sector in the market.

Technology (XLK)

Tech has come on strong over the past six weeks or so. Price has maintained an uptrend throughout the year, but only recently has the group been leading the market. For almost the entire up move this year, Tech leadership was largely absent. I am of the belief that Tech could really make a strong push from around these levels and lead the market in a year end rally. The gap and go breakout in mid-October looks strong for the near term prospects of the group.

Industrials (XLI)

Industrials have been great. The relative strength of the group has been very strong since May when they experienced a gap and go breakout. There was a nice correction after that strong initial rally (it filled the gap from the May breakout almost to the penny), but that just set the stage for an even stronger leg up from July to November. New highs, higher lows. This is a winner.

Materials (XLB)

Materials keep looking like they want to do something big, but are sure taking their time getting there. They are still holding up fine and performing in line with the S&P. We certainly have a decent uptrend and after seeing strong action on Friday, I hope this will step up the pace a bit. The rally from October, that has now slowly corrected, looks to have formed a bull flag pattern and a break above $44.40 would set up another leg higher.

Energy (XLE)

Energy is in the same boat as Materials. Every time you think its about to start moving again, it stalls a bit. Its a choppy uptrend, but we still continue to see new highs none the less. Even though its been sloppy recently, you could make the case that it too is setting up a bull flag type pattern and is looking to extend its new highs streak a little longer. With oil coming down in price pretty drastically over the past two months, I think its due for a bounce, which would also help the group as a whole push to new highs.

------

Defensive Groups

Health Care (XLV)

The strongest of the Defensive groups, Health Care has been a source of market strength all year long. It has consistently made new highs and is holding its most recent breakout very well. I have been seeing a lot of the individual names within the XLV show strong breakouts as well. This still looks like a winner.

Staples (XLP)

The Staples have underperformed significantly since topping out in May. The first half of the year run was epic; there were barely more than a handful of down days over a 6 month period! But since that rally, price has really consolidated those gains and took a lot of the froth out of the group. As we have discussed recently, the XLP looks to be signaling that it wants to continue it previous move higher from this long sideways base. The breakout over the last couple weeks has held and as long as prices can hold these new highs, this thing has a chance to duplicate its January-June momentum.

Utilities (XLU)

Utilities look like an even sloppier version of the Staples. I actually got a false entry signal in XLU on Thursday, but then promptly exited the position at the end of the day Friday, when my breakout signal rolled over and failed. I think these are close to setting up a nice risk reward, but its still just a bit too soon to get fully on board.

20+ Year Treasuries (TLT)

As the primary "anti-stocks" asset class, long term Treasury Bonds have been slaughtered all year. The only meaningful rally occurred over a 2 month period from March to May, but certainly has the look of a secondary move against the primary down trend. The consolidation from August to now has a very similar feel and Friday's gap down through the short-term uptrend support shows more weakness is likely. This could be setting up two bearish looking patterns. The most recent bounce looks to have formed the flag portion of a continuation bear flag pattern, and also Friday appears to be a gap and go to the downside. Stocks gap up, Bonds gap down. Stocks press against new highs, Bonds press against new lows. The top in Stocks is not in, the bottom in Bonds is not in.

Gold (GLD)

The "fear gauge", the "end of the world" trade, Gold has gotten crushed this year. Gold tried to stabilize and rally back from the July low, but was unable to take out the $138 high from June and has since continued lower. I did have some interest in this setting up to break the downtrend, but any reversal attempt is taking longer than it should for a strong reversal. This just simply needs more time and there are clearly better places to put your money at this point.

The whole point of what I'm trying to do here is show how you can use the behavior of price to avoid the weakest and more high risk areas of the market. At the same time, identifying where the strength and relative performance in the market is. By looking simply at price you can see what is working and what isn't. That's the name of this game: Put your money into the places that are working, not the ones who are failing to keep up.

If you had a typical "asset allocation" portfolio model, at the age of 50 (which would likely mean roughly a 50% stock, 40% bonds, and 10% Gold), the typical mutual fund or 401k strategy would have half of your money tied up in these two horrible preforming asset classes. This "diversification" has not only cost you a significant loss on half of your investments, it takes away from the gains you have seen in your correctly positioned stock exposure.

I'm trying to help people see the returns that are possible and the very small amount of risk it takes to acquire those returns. With those "buy and hold", asset allocation models, you maintain 100% market exposure at all times. Are those kinds of returns worth 100% risk? With a trend following strategy you are never exposed to the large scale crashes because your trend signals invalidate before the bottom falls out. With a simple online brokerage account you can safely and successfully manage AT LEAST a portion of your investment savings with this simple trend following strategy.

This stuff is not magic, folks...Its Chart Porn!

Tuesday, November 5, 2013

Reducing 3D Systems (DDD) Cup Target Acquired!

A very nice move in DDD over the past several weeks! The stock up more than 35% since our entry (entry post here) and with this morning's sharp rally, we have acquired our rounding bottom/Cup target at $69. As is my plan with target acquisitions, I am reducing my DDD holdings by 1/2 into this bounce today. If it just keeps ripping straight up, well then we still hold a half position. If it corrects back into strong support, we will add back to our position. Once you have a major pattern completion, the stock will typically burn off some of the extra oomph it has recently had and usually will correct either through time or price. Meaning the risk/reward is no longer skewed in our favor, therefore we reduce our position size.

Not much more to say than that, and a picture speaks a thousand words. This has been a monster for 2013 and I have traded it successfully since the $30 lows at the end of last year. Big winner for all my accounts and now, hopefully, a big winner for yours too.

Not much more to say than that, and a picture speaks a thousand words. This has been a monster for 2013 and I have traded it successfully since the $30 lows at the end of last year. Big winner for all my accounts and now, hopefully, a big winner for yours too.

Saturday, November 2, 2013

Weekend Update: Is the Market Extended?

There was not too much movement this week in the major averages as the S&P gained only 3 points. But still, the fact that we didn't see a quick move back below the upper resistance line is encouraging going forward. With only 2 months remaining in 2013, traders are gearing up for a highly anticipated year-end rally. Being that we closed another month, we need to take a look multiple time frames to put this rally in continued context with the bigger picture.

SP500 (daily)

Shorter term the market is holding its breakout very well and developing any downside momentum has been difficult for the Bears. With expectations into year end sky-high, it will be interesting to see if once again the market fools the herd and does something unexpected (when have we seen that before?). For the unexpected to happen however, first we need to see the uptrend channel resistance fail to hold as support here and we would then need to see the prior high from the breakout at 1,730 broken as well. As of now the thesis for a year end rally seems intact and above these levels we should expect higher prices.

The arrow in the above chart is pointing to the breakout gap that occurred when the market made a new high in early October. Gaps are caused by very high supply/demand imbalances that cause a stock to "jump" between trading sessions and typically act as a significant signal for the following move in the direction of the gap. Once a gap is created, that space will become a significant area of interest going forward. Markets tend to like to "fill" gaps and usually will trade back to where the gap occurred; these "gap fill" scenarios often create nice risk reward setups once the gap is filled. As you can see above, should the market trade back to the gap area it would also coincide with the prior high breakout level and the rising 20 DMA...Which would be a great, low risk place to put on a short term trade.

SP500 (Weekly)

The intermediate view of the SP500 still looks solid, although being above the upper channel boundary usually reduces the likelihood of a strong risk/reward for new intermediate term positions. If you are a weekly chart trader, these levels are good places to trim some solid gains and wait for a more favorable setup.

Something else that looks positive is the steady accumulation of shares trading hands over the past few weeks. Its a good sign to see new highs greeted with higher trading volumes. This alone is not a signal to buy these highs on an intermediate term, but it does show persistent interest for stocks at these levels.

SP500 (Monthly)

Looking at the long term view shows very strong follow through above the prior all-time highs since the breakout. This is very bullish action and suggests higher prices longer term. I am a bit concerned how extended current prices are above the 20 MMA, as we have seen in past rallies, an extension this high above the moving average tends to create a retracement back to the longer term average. And just for context, the distance price was from the key moving average at the end of October was the furthest we have seen at any point in the last 20 years! Extended? I say so. This market could correct over 260 points and still not even hit that 20 month average.